I've got Draghi fever, she's got Draghi fever

We've got Draghi fever, we're in debt

She's gone Dollar crazy, I've gone Euro hazy

Are we still taking this GS puppet seriously?

Well, someone is as the Global Markets are anxiously waiting to hang on every word Draghi says in his speech following the ECB rate non-decision (you heard it here first) at 8:30. The truth is that the Central Banksters are running out of ammunition and have now begun to ask the Governments to reverse the austerity programs they demanded to now stimulate the economies before deflation begins to erode the value of the Bankster's assets, which would collapse their loan to value ratios and lead to BIG TROUBLE in very short order.

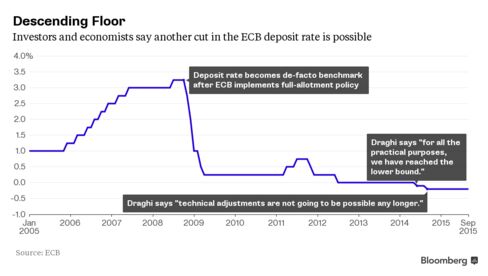

The ECB is already running a $1.2 TRILLION bond-buying program, providing up to $70Bn in MONTLY artificial support for Sovereign Debts. Without this backstop - one has to wonder what the real interest rates in Europe would be. All that this form of QE actually accomplishes is allowing countries with very risky credit to borrow more and more money while the population of savers is underpaid on their retirement accounts.

The ECB is already running a $1.2 TRILLION bond-buying program, providing up to $70Bn in MONTLY artificial support for Sovereign Debts. Without this backstop - one has to wonder what the real interest rates in Europe would be. All that this form of QE actually accomplishes is allowing countries with very risky credit to borrow more and more money while the population of savers is underpaid on their retirement accounts.

Did I say underpaid? That's an understatement as rates have now gone NEGATIVE as some banks are now charging fees to depositors and paying no interest at all! The official rates in Switzerland, Sweden and Denmark have already gone negative as Governments are pulling out all the stops to get their people to throw their retirement accounts into the stock market or, in the very least - to go spend it on something.

Does that sound insane? Insanity is defined as doing the same thing over and over again and expecting different results. Along with the ECB decision at 8:30 we'll see the Chicago Fed Report and that, like most Manufacturing Reports of late, is likely to be weak - a very strong indicator that economic momentum is DECLINING during this record QE season, not expanding at all. QE simply does not work - but it's the only play in the Central Banksters' playbook.

Meanwhile, just to keep you up to date:

Germany lowered their own GDP forecast to 1.7%, citing China weakness -

Hong Kong home prices are projected to fall 17% - Yet they say China's GDP grew 6.9%

China Capital Outflows are at record highs - Yet they say China's GDP grew 6.9%

China is consolidating it's 3 state airlines - Yet they say China's GDP grew 6.9%

South Korea's exports dropped 8.4% - Yet they say China's GDP grew 6.9%

Vale's net revenue dropped 28% and they lost $2.12Bn - Yet they say China's GDP grew 6.9%

Samsung lost $1.3 Trillion Won (vs 15.9Bn profit expected) - Yet they say China's GDP grew 6.9%

Honda cancelled an $822M China Plant on slow demand - Yet they say China's GDP grew 6.9%

Hyndai's sales to China fell 17.4% - Yet they say China's GDP grew 6.9%

Those are just today's headlines folks! When 16% of the World's economy is obviously a lie - don't you think you should be a bit concerned about what other lies you are being told? As noted by David Stockman:

The odds that these reports represent anything other than goal-seeked propaganda are so overwhelmingly high that they perforce raise another more important question. Why does Wall Street and its servile financial press not issue a loud collective guffaw when they are released?

In truth, Wall Street has become so intellectually addled from its addiction to central bank enabled gambling that it no longer has a clue about what really matters. That’s why the next crash will come as an even greater surprise than the Lehman meltdown, and will be far more brutal and uncontainable, as well.

Indeed, its goes all the way back to Mr. Deng’s moment of enlightenment 25 years ago. That’s when he discovered a printing press in the basement of the PBOC and concluded that communist party power might better be preserved by running these presses red hot than by Mao’s failed dictum that power descends from the white hot barrel of a gun.In any event, why in the world would anyone in their right mind think this crucial chart can be extended toward the right axis much longer. Assume 10 more years of 12% credit growth, for example, and China will have $90 trillion of total debt or 50% more than the already staggering amount carried by the US economy.

On the whole, China is not doing anything different than the ECB, the BOJ or the Fed are doing - they are just ALSO cooking the books to make it look like it's working. As we expected, there was no policy action by the ECB this morning but Draghi said they will do "whatever it takes" to get the economy going and that was all the markets needed to fly higher as the Euro dropped like a rock and sent Euro-priced assets flying higher.

Also, McDonald's (MCD) had a nice beat this morning and is up $8, which is good for about +70 Dow points all by itself so Dow Futures (/YM) are back to 17,200 - where we had fun shorting them yesterday. In fact,. the Futures shortring lines (and rules) we had in effect yesterday still apply today and yesterday our trade ideas from the morning post gained $5,000 before lunch!

We're already short China's ETF (FXI), of course and the stronger Dollar will not be good for oil (we're short) or natural gas (we're long) or gold or silver or copper and it will make for an interesting day. 3M (MMM) and Caterpillar (CAT) both disappointed (also on China) so that should keep the Dow under 17,200 and it's my favorite short this morning.

Be careful out there!

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.

Now China has lowered their lending rates - again!

Now China has lowered their lending rates - again!