In a recent IZA World of Labor article, Joni Hersch of Vanderbilt University surveys and compares the available international evidence. She states that "despite being illegal, costly, and an affront to dignity, sexual harassment is pervasive and challenging to eliminate." While the legal frameworks vary by country, sexual harassment is generally regarded as "unwelcome and unreasonable sex-related conduct." The author finds that sexual harassment is much more common than one might think: On average 30 to 50 percent of women have experienced sexual harassment, with rates ranging from 11 percent in Denmark to 81 percent in Australia. These striking differences, however, are not entirely due to cultural differences as survey methods differ by country.

What does the evidence tell us?

Although men experience sexual harassment as well (on average about 10 percent in countries where this has been measured), the typical victims are young females holding a lower-rank job in a male-dominated environment. The harassers, on the other hand, are predominantly males who work at the same or higher hierarchical level. Organizational characteristics play a role as well, especially when it comes to large power differentials in the hierarchical structure and the organization's tolerance for sexual harassment.

Tolerance seems to vary by industry. The construction industry, transportation and utilities are especially prone to sexual harassment in terms of charges filed. Yet, this evidence might grossly understate the problem since, for instance, 90 percent of US government workers who had experienced sexually harassing behaviors did not take formal action, possibly fearing retaliation and a worse working and health situation subsequently.

Costs of sexual harassment are likely to be severe and occur in form of lower job satisfaction, worse psychological and physical health, higher absenteeism, less commitment to the organizations, and a higher likelihood of quitting one's job. For the US, estimated costs of sexual harassment over a period of two years accounted for about $327 million. A second source estimated an individual cost of $22,500 per person affected by sexual harassment, both numbers primarily driven by reduced productivity. It is thus, damaging and costly to both the victims and the organizations where it happens (apart from productivity losses also internal and legal costs resulting from dealing with complaints).

Sexual harassment at the workplace is still there - what should be done?

Despite sexual harassment being costly and illegal so far legal and market incentives have not been successful in eliminating it. Joni Hersch argues that these incentives may be weakened by monitoring and enforcement costs as well as the underreporting of sexual harassment. The institutional tolerance is a decisive factor for the occurrence of sexual harassment.

Although empirical evidence on the efficacy of workplace policies in reducing sexual harassment is limited, there is a consensus that emphasizing prevention, issuing strong policy statements of no tolerance, and providing safe complaint procedures protecting against retaliation can be considered best practices. Policies aiming at increasing reporting strengthen legal enforcement and increase costs to organizations for example if they are publicly recognized as tolerant of a sexual harassing environment. Trainings for appropriate behavior might also help since workers who become more aware of what behaviors constitute sexual harassment may be motivated to avoid such behaviors as well as to enforce that norm in their workgroup.

However, one should be careful not to define sexual harassment too broadly to include behavior intended as collegial or friendly, potentially creating an atmosphere of distrust and ambiguity as feared by many male co-workers in the US. Also, not all countries worldwide have legally acknowledged sexual harassment to begin with. Especially many countries in the Middle East, but also Japan, currently do not possess a law that makes sexual harassment an illegal practice.

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.

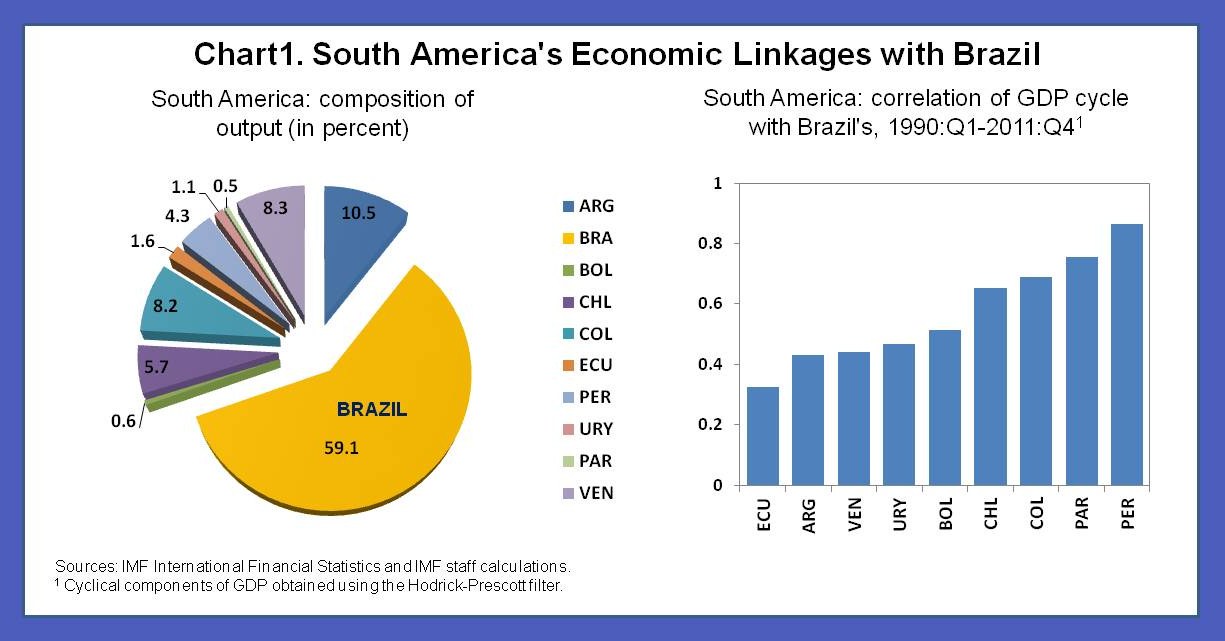

Obviously, things are pretty grim in Brazil, who's economy is close to 60% of South America's output. Is this just another thing the markets will choose to ignore as they rally back to new highs? Frankly, I don't know as this week's move is already insane - so we don't bet on irrational markets to suddenly behave rationally but TG we're in CASH!!!

Obviously, things are pretty grim in Brazil, who's economy is close to 60% of South America's output. Is this just another thing the markets will choose to ignore as they rally back to new highs? Frankly, I don't know as this week's move is already insane - so we don't bet on irrational markets to suddenly behave rationally but TG we're in CASH!!!

We are long SDS, it's one of our primary hedges in our Short-Term portfolio and obviously we're not alone in our grave concerns over the sustainability of the valuations in the S&P 500 as we barrel headlong into the thick of earnings season next week. So far, the early earnings season action has been back and forth but back and forth doesn't cut it when your index is trading at record highs!

We are long SDS, it's one of our primary hedges in our Short-Term portfolio and obviously we're not alone in our grave concerns over the sustainability of the valuations in the S&P 500 as we barrel headlong into the thick of earnings season next week. So far, the early earnings season action has been back and forth but back and forth doesn't cut it when your index is trading at record highs!