Wheeeeee, what fun!

Wheeeeee, what fun!

As noted in our Weekend Portfolio Review, we are in CASH!!! so we really don't give a crap which way the market goes. Despite having plenty of long positions (short puts in our Long-Term Portfolio), we'd be thrilled to actually get to buy the stocks cheaply and we'd also be thrilled to do a bit of bargain-hunting if we get another nice dip - so that's what we're rooting for.

As you can see from Dave Fry's SPY chart, yesterday's move was, as we predicted in the morning post, complete and utter BS and, in fact, declining volume outpaced advancing volume on the NYSE by 50% in an "up" day. This is classic end-stage manipulation - try not to fall for it!

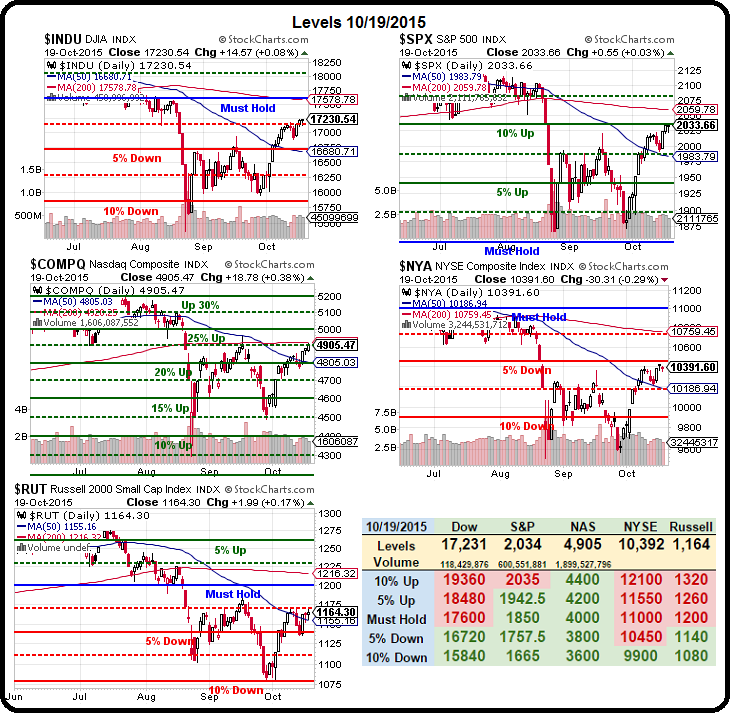

2,035 on the S&P is, of course, the 10% line on our Big Chart. That means it's no surprise that we're getting rejected here and the run-up was from 1,850 so that's just under 200 points so we'll look for a 40ish-point pullback to 2,000 and holding that would be bullish but a fall to 1,950 would be bearish again and anything below that signals we're probably going to be seeing 1,850 again:

It's useful to have a magical chart that tells us what's going to happen before it does. Thanks to our fabulous 5% Rule™, we're usually able to stay well ahead of the markets and we're also going be watching 4,925 on the Nasdaq, 10,450 on the NYSE and 1,180 on the Russell as potential rejection points and the Dow is already in a dead zone at 17,200 so that's the bull/bear indicator of the moment (whichever side it's on).

.jpg) While we are waiting for market clarity, we've been cashing in on our Futures trades. In last week's Live Trading Webinar, we went long on Natural Gas (UNG) Futures (/NG) and this morning we closed out our /NGX5 (Nov) contracts at goal and let our Dec contracts ride. As you can see, we did quite well with the trade but we're expecting to do even better on the December contracts - now trading at $2.68 off our $2.6515 entry. Our goal is $3, so that's still 0.32 to go at $100 per penny, per contract if all goes well.

While we are waiting for market clarity, we've been cashing in on our Futures trades. In last week's Live Trading Webinar, we went long on Natural Gas (UNG) Futures (/NG) and this morning we closed out our /NGX5 (Nov) contracts at goal and let our Dec contracts ride. As you can see, we did quite well with the trade but we're expecting to do even better on the December contracts - now trading at $2.68 off our $2.6515 entry. Our goal is $3, so that's still 0.32 to go at $100 per penny, per contract if all goes well.

We will have a FREE Live Futures Trading Webinar today at 1pm, EST and we'll be tweeting out a link from our account, which you can follow HERE. Another way you can play bullish on Natural Gas (our favorite play of the moment) is to buy the UNG ETF, which is currently at $11.21 - we already have an aggressive spread on UNG in our Options Opportunity Portfolio, which you can follow by signing up HERE.

I'm sorry I don't have specific trades for the cheapskate readers but it's earnings season and we don't to free trades during earnings season. Don't worry though, in late November we'll be happy to give away some more free trade ideas so don't sign up or you might get ideas like these from last weeks' Morning Posts (and no, I'm not leaving out bad ones - go check!):

I'm sorry I don't have specific trades for the cheapskate readers but it's earnings season and we don't to free trades during earnings season. Don't worry though, in late November we'll be happy to give away some more free trade ideas so don't sign up or you might get ideas like these from last weeks' Morning Posts (and no, I'm not leaving out bad ones - go check!):

10/13 - FXI Nov $40/38 bear put spread at $1, now 0.85 - down 0.15 (15%)

10/14 - 20 AAPL 2017 $80/110 bull call spreads with 20 short 2017 $75 puts for net $32,540, now $33,760 - up $1,220 (3.7%)

10/14 - 10 BHI 2017 $40/50 bull calls spreads with 10 short $45 puts at net $2,100, now $4,200 - up $2,100 (100%)

10/16 - Short Russell Futures (/TF) at 1,160, fell to 1,150 - up $1,000 per contract.

10/16 - Long SDS at at $20.71, now $20.60 - down 0.5%

10/16 - CASH!!! at 94.50 (Dollar index), now 94.75 - up 0.26%

10/19 - FXI Jan $41 puts at $3.20, now $3.42 - up 6.8%

.jpg) That takes us back to our October Top Trade Review, where you can check out another 10 trade ideas, some of which are still playable. I've been criticized for giving away too many free trade ideas but I think it's important to let you know that, when I do have an idea like going long UNG (can't specify a trade) and say it's my favorite - perhaps you may see that I might have some clue as to what will happen in the markets.

That takes us back to our October Top Trade Review, where you can check out another 10 trade ideas, some of which are still playable. I've been criticized for giving away too many free trade ideas but I think it's important to let you know that, when I do have an idea like going long UNG (can't specify a trade) and say it's my favorite - perhaps you may see that I might have some clue as to what will happen in the markets.

Also, these are a mere sliver of the trade ideas we have for our Members each week and the funny thing is that PSW is not even a "trading" site. We are an education site that teaches you how to identify your own opportunities and we simply make these calls as examples to demonstrate the usefulness of our system. The fact that they often happen to work out is a testimony to the system more than anything else.

In addition to today's FREE Live Trading Webinar (and now I have the link), where we will de-mystify Futures Trading for you - we are having a Live Seminar in Washington, DC on Nov 14th where we will focus on the Butterfly Portfolio which is, by far, our most reliable trading strategy, year after year.

Apparently, according to the splash page, I'm also going to talk about my "Top Picks for 2016" - gosh, that's a lot of pressure - I'd Better Make a decision soon!

This morning we already decided to short the Futures in our Live Member Chat Room but, unfortunately, I can't discuss that with you as it's earnings season but there's a clue as to where at the beginning of this post if you are a clever reader!

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.