The world is out of balance. Everyone's nervous. There is a glut of money floating around the world and no one offers a "safe place" to put it. The stock market is way up, way down, way up, way down - sometimes all on the same day. China's currency is having dramatic swings while the U.S. has an enormous, humongous trade deficit.

Super-wealthy people are making and losing hundreds of millions (sometimes billions) in a day - none of it on making or doing actual things that matter. Inequality is soaring. (The top 25 hedge fund managers earn more than all kindergarten teachers in the U.S. combined.) And all around the world, there's very little actual economic growth.

Meanwhile, most people barely (or don't) have enough to get by.

This is inequality: a ton of money at the top, everyone else hunkered down just trying to get by (or not getting by), forced to spend very little. Companies are afraid to expand if no one is spending. The result is poor demand to guide the way to safe investment. But governments - the source of demand when people and companies are hunkered down - keep cutting back.

Why the imbalances? Too much money at the top, concentrated in too few hands. Paul Krugman's New York Times column Monday, "A Moveable Glut," preceded today's 1,100-point stock market drop at the opening bell:

Each imbalance is a measure of people with wealth and power using that wealth and power to rig the system to keep things flowing their way. Our trade deficit measures factories closed and jobs shipped out so a few can pocket the wage differential. The more than $2 trillion parked in tax havens by U.S.-based multinational corporations - representing up to more than $700 billion in taxes owed but not paid - measures schools not opened, roads not built, teachers not hired, scientific research not done; in other words, the resources not being used to provide a solid underpinning for our economy. Currency swings measure "hot money" chasing around the world for a return.

Do the wealthy few say, "Hey, what I am doing is throwing the whole system out of whack, killing the chance of future prosperity?" Hell no, they don't; this is all working just great for the few people who are ending up with all that money. And those are the people putting up the money to propagandize the public, saying government shouldn't be interfering with what's going on.

Government Spending Creates Demand

Speaking of government, the biggest imbalance in the world right now is the degree to which governments have cut back on badly needed spending. Government is supposed to be the engine of growth. Government is the segment of the economy that invests in the basics - such as infrastructure, education and research - that provide the fertile ground from which prosperity springs.

But around the world, especially in Europe, tax-starved governments, forced into austerity budgets that are slowing their economies, are cutting back, cutting back, cutting back. Always, the prescription for slowing economies resulting from austerity is ... more austerity, because "government gets in the way of doing business."

Spending on infrastructure, social welfare, education, regulation of markets, regulation of corporate behavior are all cut back. All of these cuts slow the ability of people to participate in the economy. All of these cuts kill off the very things that bring about future economic growth.

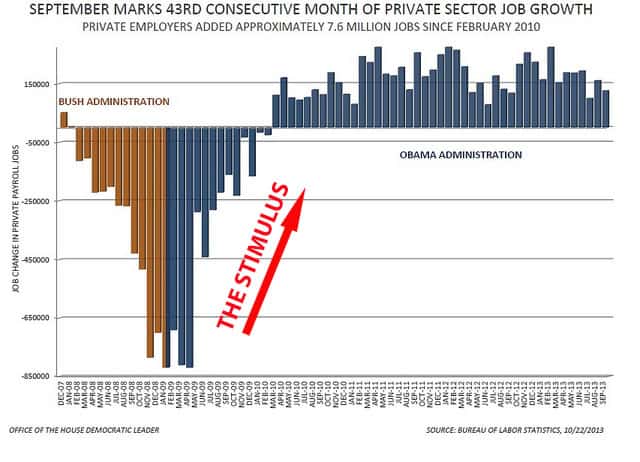

Right after President Obama took office with a Democratic House and Senate to back him up, the U.S. tried the opposite of austerity cutbacks and enacted the "stimulus." This chart from two years ago shows what happened:

![]()

The economy was losing more than 800,000 jobs a month. That was reversed. The meager amount of actual investment in the stimulus, (a big chunk just halted the firing of teachers, police and other public workers, and one-third was spent on tax cuts people didn't even know they got), brought about the foundation for the at least low-to-slow growth we've had since. That bit of government spending on infrastructure, education and research laid down a real foundation for at least some future economic growth.

But then came the surrender to the "sequester" and other austerity. Investment in U.S. infrastructure since the Reagan tax cuts is just awful. The American Society of Civil Engineers' most recent "Infrastructure Report Card" estimates we need to spend $3.6 trillion by 2020 just to get to normal standards. And after maintenance on our basic infrastructure - bringing it all up to 21st-century standards - we need to invest in a nationwide high-speed rail network, a nationwide "smart grid" power system, and more. These require major investment, and the amount is a measure of how far we have let ourselves fall behind.

Government investments bolster growth. The important part is the spending. The country needs real work done on real things we need in a big way. Imagine the hiring and wage boosts if we spent the needed $3.6 trillion in the next few years, plus investment in new things like high-speed rail. If we issued $3.6 trillion in new government bonds to soak up some of that glut of "hot money," we would put a stop to the "bubble economy" of financialization chasing after fast returns from investment in nothing real.

In market terms, this glut of money looking for a safe haven is proof the U.S. needs to borrow more (taking advantage of the high demand for U.S. bonds and the high prices investors are willing to pay) and use the money to invest in our economy (thereby providing the means to pay off the bonds).

There is little to no growth in the world economy right now; no country is serving as an engine that can provide the needed thrust for growth, and the money glut has no good place for investment. In this environment, clearly our government should be spending money - not debating how much we cut. It works. Look at that chart again. It works. What we need is real stuff getting done now, hiring real people in real jobs and laying the foundation for a real economy that really works.

----

This post originally appeared at Campaign for America's Future (CAF) at their Blog for OurFuture. I am a Fellow with CAF.Sign up here for the CAF daily summary and/or for the Progress Breakfast.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Super-wealthy people are making and losing hundreds of millions (sometimes billions) in a day - none of it on making or doing actual things that matter. Inequality is soaring. (The top 25 hedge fund managers earn more than all kindergarten teachers in the U.S. combined.) And all around the world, there's very little actual economic growth.

Meanwhile, most people barely (or don't) have enough to get by.

This is inequality: a ton of money at the top, everyone else hunkered down just trying to get by (or not getting by), forced to spend very little. Companies are afraid to expand if no one is spending. The result is poor demand to guide the way to safe investment. But governments - the source of demand when people and companies are hunkered down - keep cutting back.

Why the imbalances? Too much money at the top, concentrated in too few hands. Paul Krugman's New York Times column Monday, "A Moveable Glut," preceded today's 1,100-point stock market drop at the opening bell:

For seven years and counting we've lived in a global economy that lurches from crisis to crisis: Every time one part of the world finally seems to get back on its feet, another part stumbles. [. . .] But these aren't just a series of unrelated accidents. Instead, what we're seeing is what happens when too much money is chasing too few investment opportunities.

Each imbalance is a measure of people with wealth and power using that wealth and power to rig the system to keep things flowing their way. Our trade deficit measures factories closed and jobs shipped out so a few can pocket the wage differential. The more than $2 trillion parked in tax havens by U.S.-based multinational corporations - representing up to more than $700 billion in taxes owed but not paid - measures schools not opened, roads not built, teachers not hired, scientific research not done; in other words, the resources not being used to provide a solid underpinning for our economy. Currency swings measure "hot money" chasing around the world for a return.

Do the wealthy few say, "Hey, what I am doing is throwing the whole system out of whack, killing the chance of future prosperity?" Hell no, they don't; this is all working just great for the few people who are ending up with all that money. And those are the people putting up the money to propagandize the public, saying government shouldn't be interfering with what's going on.

Government Spending Creates Demand

Speaking of government, the biggest imbalance in the world right now is the degree to which governments have cut back on badly needed spending. Government is supposed to be the engine of growth. Government is the segment of the economy that invests in the basics - such as infrastructure, education and research - that provide the fertile ground from which prosperity springs.

But around the world, especially in Europe, tax-starved governments, forced into austerity budgets that are slowing their economies, are cutting back, cutting back, cutting back. Always, the prescription for slowing economies resulting from austerity is ... more austerity, because "government gets in the way of doing business."

Spending on infrastructure, social welfare, education, regulation of markets, regulation of corporate behavior are all cut back. All of these cuts slow the ability of people to participate in the economy. All of these cuts kill off the very things that bring about future economic growth.

Right after President Obama took office with a Democratic House and Senate to back him up, the U.S. tried the opposite of austerity cutbacks and enacted the "stimulus." This chart from two years ago shows what happened:

The economy was losing more than 800,000 jobs a month. That was reversed. The meager amount of actual investment in the stimulus, (a big chunk just halted the firing of teachers, police and other public workers, and one-third was spent on tax cuts people didn't even know they got), brought about the foundation for the at least low-to-slow growth we've had since. That bit of government spending on infrastructure, education and research laid down a real foundation for at least some future economic growth.

But then came the surrender to the "sequester" and other austerity. Investment in U.S. infrastructure since the Reagan tax cuts is just awful. The American Society of Civil Engineers' most recent "Infrastructure Report Card" estimates we need to spend $3.6 trillion by 2020 just to get to normal standards. And after maintenance on our basic infrastructure - bringing it all up to 21st-century standards - we need to invest in a nationwide high-speed rail network, a nationwide "smart grid" power system, and more. These require major investment, and the amount is a measure of how far we have let ourselves fall behind.

Government investments bolster growth. The important part is the spending. The country needs real work done on real things we need in a big way. Imagine the hiring and wage boosts if we spent the needed $3.6 trillion in the next few years, plus investment in new things like high-speed rail. If we issued $3.6 trillion in new government bonds to soak up some of that glut of "hot money," we would put a stop to the "bubble economy" of financialization chasing after fast returns from investment in nothing real.

In market terms, this glut of money looking for a safe haven is proof the U.S. needs to borrow more (taking advantage of the high demand for U.S. bonds and the high prices investors are willing to pay) and use the money to invest in our economy (thereby providing the means to pay off the bonds).

There is little to no growth in the world economy right now; no country is serving as an engine that can provide the needed thrust for growth, and the money glut has no good place for investment. In this environment, clearly our government should be spending money - not debating how much we cut. It works. Look at that chart again. It works. What we need is real stuff getting done now, hiring real people in real jobs and laying the foundation for a real economy that really works.

----

This post originally appeared at Campaign for America's Future (CAF) at their Blog for OurFuture. I am a Fellow with CAF.Sign up here for the CAF daily summary and/or for the Progress Breakfast.

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.