And now reality sets in.

And now reality sets in.

It's becoming more and more clear that the stock market emperor has no clothes - and no earnings either and more and more people are starting to catch on. To some extent, that's a good thing as the misallocation of capital can finally stop and we can get back to investing in productive things - not just instruments of financial engineering. Unfortunately, it's likely to be a painful transition and we do expect a bit of a correction in the market, probably back to test 1,850 on the S&P next month, which hopefully will hold.

For the past 5 years, Corporate America has been on a drunken binge of stock buybacks that have left them with mountains of debt, albeit at very low interest rates. Spending $2Tn buying back their own stock instead of inventing new products and building new factories is what leads to the outsourcing of manufacturing to other countries, where they still believe in the basics. In the short-term, it makes Corporate Profits LOOK better by reducing the share count but, in the long run, the debt rolls over at higher rates and the company, like our country, is saddled with massive debt payments that prevent it from being able to invest in the future.

At the same time, we've already passed the peak of Corporate Profits in real terms, as noted on this Fed chart, and ONLY the reduction in share count engineered by Trillions in buybacks have prevented this from severely impacting the p/e ratios of the market - just as an M&A boom masked the underlying problems corporations were having ahead of the 2008 crisis.

At the same time, we've already passed the peak of Corporate Profits in real terms, as noted on this Fed chart, and ONLY the reduction in share count engineered by Trillions in buybacks have prevented this from severely impacting the p/e ratios of the market - just as an M&A boom masked the underlying problems corporations were having ahead of the 2008 crisis.

To some extent, these are normal business cycles as we moved from the Tech Boom of the 90s to the Housing Boom of the 00s to the stimulus boom of the 10s and now we're back in the bust phase so, as the great Clayton Williams would say: "If it's inevitable, just relax and enjoy it."

What's also inevitable is how screwed we are demographically as we move into peak retirement years for Baby Boomers. The Baby Boomers are people born between 1946 (70 now) and 1964 (52) and represent a huge population bubble moving through our system. As someone living at the tail end of the Baby Boom, my whole life has been fantastic as every trend catering to my generation is fully built out by the time I'm ready to use it.

What's also inevitable is how screwed we are demographically as we move into peak retirement years for Baby Boomers. The Baby Boomers are people born between 1946 (70 now) and 1964 (52) and represent a huge population bubble moving through our system. As someone living at the tail end of the Baby Boom, my whole life has been fantastic as every trend catering to my generation is fully built out by the time I'm ready to use it.

Like, for example, when I was a teen, my town had dozens of bars with live bands on weekends and happy hours and when I went to college, there were huge new facilities that were built for the rising student populations and, now that I'm 53, half the movies are super-hero movies - the stuff I loved when I was a kid (and still do) and there's a huge industry devoted to keeping me young and healthy - something I'm only now starting to think about.

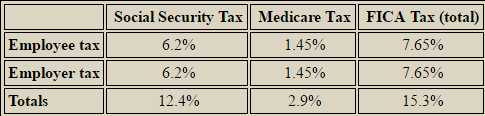

Unfortunately, after being demographically catered to our whole lives, we're now running into the part where all that money we paid into Social Security over the years is supposed to be paid back to us. Even more unfortunately, Al Gore's lock box was busted open by the Bush administration and there simply isn't enough money to support us all in our retirement. Granted life expectancy is way up but, to be fair, we put in 15.3% of our salaries (7.65% from us, 7.65% from our employers) for our whole lives.

Let's say that you're an average worker now earning $50,000 in your 60s and ready to retire. Perhaps you earned $20,000 between 25 and 35, so that's $200,000 and $30,000 contributed. Between 35 and 45 you made $40,000 so $400,000 with $60,000 contributed. Between 55 and 65 you make $50,000 so that's $500,000 with $75,000 contributed.

So, over the course of 30 years of work, you have contributed $165,000 into a retirement system but that's not the whole story. Had you put $30,000 in the bank 30 year ago at just 5%, you'd have $134,000. Had you put $60,000 in the bank 20 years ago, you'd have $163,000 and, had you put $75,000 in the bank 10 years ago, you'd have $123,0000 so now we're talking about $420,000 that should be in the average workers' "lock box."

$420,000 would be PLENTY of money to service the $1,180.80 per month collected by the average beneficiary, even with more boomers nearing retirement age but, as we all know, the money isn't really there and it was never invested so the Government doesn't have anything near the $24Tn it should have sitting in the pension fund. And THAT makes Boomers VERY NERVOUS! At the same time, wages are not keeping up with inflation and families are forced to go more and more into debt to simply maintain their existing lifestyles:

Outstanding consumer credit is now almost 10% HIGHER than it was before the collapse in 2008. The only saving grace we have is that, like our Corporate brothers, we're able to borrow at lower rates than we were in 2007 (or ever, for that matter). Unfortunately, these low rates are completely artificial and the true cost of maintaining them is even more Government Debt that we are ultimately saddling our children with down the road.

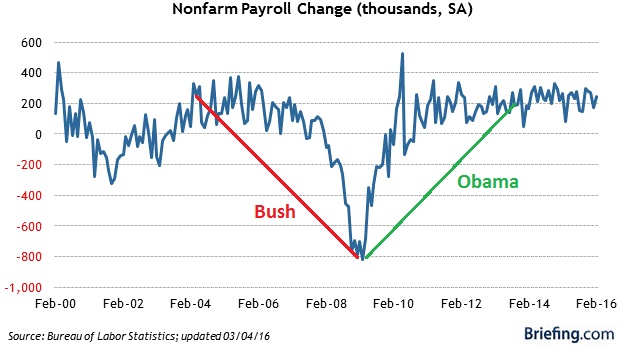

This is not a problem that will be fixed with a wave of a Federal wand so DON'T start jumping on short-term trends based on statements that "things are improving" or that we have "surprisingly good numbers." This morning, for example, we had a "strong" jobs number with 215,000 jobs added in March and an upward revision to February but the Futures are turning DOWN. Why? Because it's not about the healthy functioning of an economy anymore - it's about how much FREE MONEY our Central Banksters are going to print for us and rising employment is one of the signs that the machines may, one day, stop spitting out fresh supplies of money.

The market is in no mood at all to see the economy stand on it's own two feet because we have perverted the concept of Capitalism to create a state of Corporate Welfare that rewards the worst possible behavior and does nothing at all to benefit the nations the Corporations reside in or the ordinary people who work for them, who have become nothing more than another disposable commodity item they can crush the value of to increase profits.

Have a nice weekend,

- Phil

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.