One BILLION Dollars!

One BILLION Dollars!

That's how much ADDITIONAL money the ECB begins pumping into the markets as of tomorrow morning per Draghi's 33% increase in QE. That means, of course, he was already pumping $3Bn/day into the markets and that didn't help but, clearly, investors believe somehow that this is going to be the straw that puts the camels back back together - or whatever it is unrealistic people believe these days...

Over in Asia, stocks are headed for their biggest monthly gain since October as our own Federal Reserve Chairwoman has indicated she is in no hurry to lift U.S. interest rates either and, of course, the FREE MONEY continues to flow in Japan and China - what could possibly go wrong?

“A lot of the recent rebound has been down to the Fed back-tracking on rate hikes,” Mark Lister, head of private wealth research at Craigs Investment Partners in Wellington, which manages about $7.2 billion, said by phone. “We’ve seen a big rally but there are still some genuine worries out there. Markets had been overpricing some of the risks, whereas now they’re probably underpricing them.”

While Yellen’s dovish message from Tuesday continued to reverberate, Chicago Fed President Charles Evans signaled the central bank would tolerate above-target inflation for a “brief period” amid threats to American expansion from a slowing global economy. Futures now show no chance of the Fed altering monetary policy next month and only 45 percent odds of a rate increase by November.

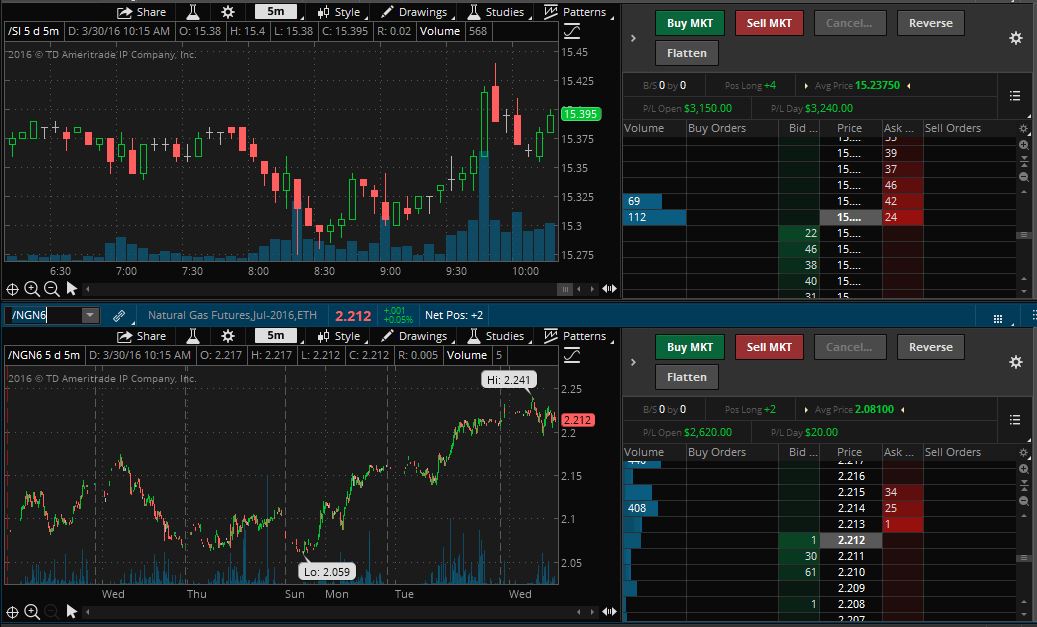

Speaking of Futures, we took the money and ran yesterday on our Futures trades from last week's Live Trading Webinar. In case you missed it (replay available here), we added Silver (/SI) at $15.2375 and got out yesterday at $15.395 for a $3,150 gain on the week and we also added Natural Gas (/NG) at $2.081 and took that money and ran at $2.212 for a $2,620 gain. Add that to the $400 we made during the webinar session and that's +$6,170 gained in seven days after spending 90 minutes watching our Webinar!

We're doing another one for our Members at 1pm this afternoon and we're certainly going to be looking for shorting opportunities after this big market run. Meanwhile, I've been away this week (back now) and we haven't touched our 4 Member Tracking Portfolios and that's good as we can compare them to Sunday's March Portfolio Review to see how well-balanced we are in our untouched positions. The S&P is up 2% in 3 days, from 2,035 to 2,065, so we'll see how we performed against a nice bull run:

Our Short-Term Portfolio was at $487,387 (up 387.4%), now $490,012 (up 390%) - up $2,625 (2.6%)

Our Long-Term Portfolio was $859,972 (up 72%), now $885,092 (up 77%) - up $25,120 (5%)

Our Butterfly Portfolio was $238,800 (up 138.8%), now $245,995 (up 146%) - up $7,195 (7.2%)

Our Options Opportunity Portfolio was $122,250 (up 22.3%), now $127,887 (up 27.9%) - up $5,637 (5.6%)

The great thing about leaving your portfolios alone for a few days is you get to see how well-balanced you are (or aren't). In this case, we're still too bullish as we've been wanting to get neutral into the end of the Month but we already knew that as I noted in our STP review: "We've got about $120,000 of aggressive protection for our LTP but the LTP is very large now and can lose $120,000 pretty quickly. On the whole, I'd like to have us in the $160,000-$180,000 range to be a bit more comfortable, so we'll be looking for something to add next week."

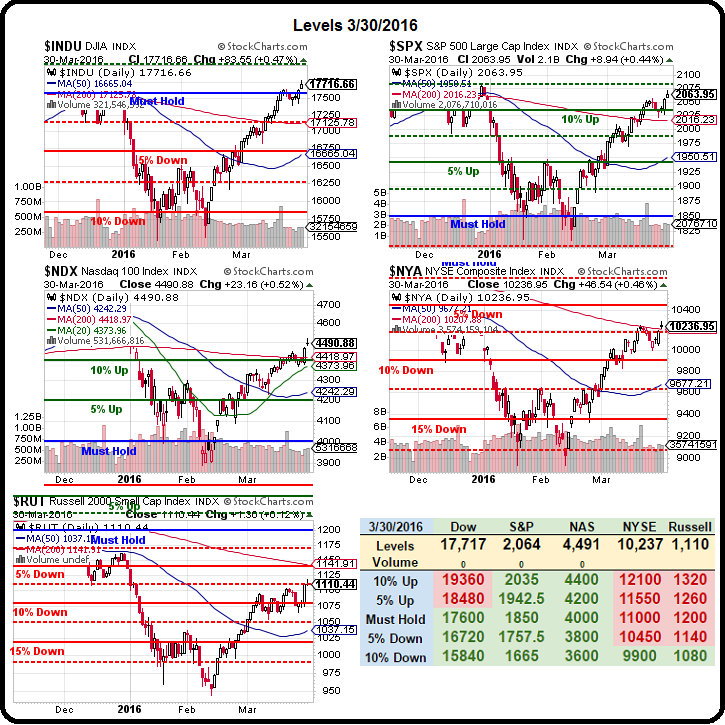

So, now it's next week and now we have another $25,000 in gains to the upside on our LTP/STP paired portfolios (the STP is the bearish offset to the LTP) and, as a rule of thumb, we want to put at least 1/3 of that ($8,000) into more downside hedges. Looking at the chart of the last 3 months, it's the Dow and the S&P that have led us higher, so that's where we'd like to short.

We already have 100 S&P Ultra Shorts (SDS) June $20 calls as our primary hedge in the Short-Term Portfolio and 25 in the Options Opportunity Portfolio, so better to spend the money to improve that position than start another one. Those calls are now 0.68 with SDS at $18.86 and that is very underpriced in my opinion since SDS was at $24.50 in mid-February.

We can take advantage of the cheap SDS pricing and extend our insurance policy to September by rolling to the SDS Sept $16 calls at $3.10 and selling the Sept $22 calls for 0.90. That roll will cost us -0.68+$3.10-0.90 = net $1.52, which is $15,200 in the Short-Term Portfolio, which is more than we wanted to spend but now we're in the money and have 3 more months of protection.

Since SDS is at $19(ish), we're $3 in the money so, if the S&P flatlines into September, we get $30,000 back. If it goes up, we get up to $60,000 back (the $6 spread x 100 contracts) and, if the S&P goes up, we may lose our $15,000 but our Long-Term Positions seem to do very well when the S&P goes up - so we'll be just fine!

That's how you balance your portfolio! OBSERVE your portfolio when you leave it alone and you'll be able to see how your positions do in various market conditions and then it's just a question of tweaking a bit to shift the balance the way you want it. This makes it MUCH easier to steer your way to consistent profits!

I'm still leaning towards just going back to CASH!!! (as noted in yesterday's post) but, so far, we haven't gotten any technically bearish signals - just the Fundamental ones. Adding these hedges is a good way of erring on the side of caution into the weekend's uncertainty and it never hurts, once in a while, to comb through your portfolio and cut out some of the dead weight.

As long as we hold those 200-day moving averages on our indexes (and NYSE is right on the line at 10,200) - we can stay bullish but we need to see the Russell confirm at 1,140 and that means it has some catching up to do - either the Russell outperforms to the upside or this rally is coming to an end. We also should expect the Nasdaq to punch over 4,500 if the rally is real (not likely) And the Dow, of course, must hold its Must Hold line at 17,600:

Any of these failures will indicate it is, indeed a good time to cash in and, frankly, I'd feel much better being in CASH!!! ahead of what are certain to be TERRIBLE Q1 earnings reports from most sectors.

Be careful out there!

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.