We took the money and ran - now what?

We took the money and ran - now what?

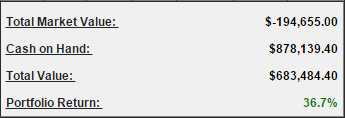

As you can see, our Long-Term Portfolio is now swimming with cash as we cashed in our winners and kept the losers. Our losing positions include 24 short put sales that currently represent about $150,000 of that "Negative Market Value," though it's not really negative because we already have the Cash on Hand (a great benefit of selling puts), so it's just a matter of how much cash we need to give back in the end.

When we sell a put, we are promising to buy a stock for a certain price (the strike) and we get paid by the holder of the stock to make that promise. They benefit by putting a price floor under their stock and we benefit from getting cash in our pockets and, ultimately, from potentially buying a stock cheaply.

Unfortunately, most people are traders, not actual investors, and they tend to forget why they entered a short put trade in the first place. Because of that, when the short put positions turn negative in a market downturn, they tend to start thinking of them as losses, rather than progress made towards buying the stock at our discount target!

In the 2013 example in the video, the stock that is used is AT&T (T) and the strategy was to sell the Jan 2015 $30 put contracts for $2. This obligated us to buy the stock for $30 in exchange for $2 paid to us by the stockholder. Had it been assigned to us, our net entry would have been $28 (as we had the $2 in our pocket) and, as you can see, $28.90 was the 2014 low and it hit Jan 2015 well above $30.

In the 2013 example in the video, the stock that is used is AT&T (T) and the strategy was to sell the Jan 2015 $30 put contracts for $2. This obligated us to buy the stock for $30 in exchange for $2 paid to us by the stockholder. Had it been assigned to us, our net entry would have been $28 (as we had the $2 in our pocket) and, as you can see, $28.90 was the 2014 low and it hit Jan 2015 well above $30.

So, in effect, we would have kept the $2 and not owned the stock and we could have then turned around and sold the Jan 2016 $30 puts for $2 and already we can sell the Jan 2017 $30 puts for $2.75 (higher premiums due to market volatility) or the 2017 $28 puts for good old $2. Either way, the concept is we don't have to own T at all (no cash out of pocket) yet we collect $2 a year, which is more than the $1.88 annual dividend we'd be buying the stock for.

If T ever does get a major sell-off, we certainly don't mind owning it cheaply and, since we've already collected $6 for not owning the stock, our net entry would be $24 - $8.50 (26%) below the current price. That's our "worst case" - and then we can turn around and sell calls against the stock, promising to sell the stock to someone else at a pre-determined strike.

If, for example, we were assigned T at $30 tomorrow, we could turn right around and sell the 2017 $30 calls for $3.50. That would drop our net basis to $24-$3.50 = $20.50 and, if the stock were finally called away at $30, our final profit would be $9.50 (46%) plus 6 dividend payments of 0.47 = $2.82 for a total profit of $12.32 on the $20.50 cash we ultimately put to work (60%).

And that is how easily we slide into our 7 Steps to Consistently Making 20-40% Annual Returns:

This video was from 2013 and you'll notice the example was Transocean (RIG), which was trading at $44.13 when the trade was initiated on May 5th of 2012 and is now trading at $13.45 - a total disaster - or was it? As noted in the video, we sold call contracts for $1.60 per month consistently against it, collecting $9.67 before being called away with an additional gain at the $46 strike.

In fact, this strategy FORCES US to cash out when a stock jumps up on us and, as you can see from this chart, that made for the perfect exit in the fall of 2014 at the $46 price mentioned in the video.

In fact, this strategy FORCES US to cash out when a stock jumps up on us and, as you can see from this chart, that made for the perfect exit in the fall of 2014 at the $46 price mentioned in the video.

Once called away, we don't jump right back in and buy the stock again, because the fact that we wait PATIENTLY for a stock to be low in the channel and THEN sell those puts to give ourselves a 15-20% discount on the next entry and THEN go back to our call-selling strategy give us a HUGE edge on passive investors.

We combine that with our basic strategies for establishing new positions - especially the practice of scaling in to new positions.

We do, in fact, have 50 RIG 2017 $13/20 bull call spreads in our Long-Term Portfolio and it is our intent to sell puts, like the 2017 $13 puts for $4.50, which would drop our net entry to $8.50, which we feel is a good enough value on the stock to commit to owning 2,500 shares (25 contracts at $11,250). This more than pays for the spread so we make a profit on every penny the stock is over $13 times 5,000 shares we control and our worst case is we'll own 2,500 shares of RIG for the long-term.

Another great, live example of a put-selling strategy is Sotheby's (BID), which is in our Options Opportunites Portfolio over at Seeking Alpha. Our current position is 20 long Jan $34 calls which we bought for $4 and are now $2.70 as BID has gone down further than we thought but now it's very attractive to sell some puts to offset the cost of those calls.

With the stock at $34.09, the 2017 $30 puts can be sold for $3.50, which is a net entry of $26.50, a nice 22% discount off the already low price. Selling just 10 of those reduces the basis on our 20 long calls by $1.75 each and now we own those long Jan $34 calls for net $2.25 and we expect Sotheby's to be back in the $40s after their next earnings report (11/11) - plenty of time for us to cash out with a nice profit!

It's a very choppy market and we've gone mainly to cash but that doesn't mean we won't be agreeing to take other people's money in exchange for our promise to buy their stock if it gets 20% cheaper than it is now. As the great Warren Buffett like to say: "Be fearful when others are greedy and greedy when others are fearful."

Our strategy of selling puts to initiate positions sets us up to be buyers when others are panicking and then, once we own the stock, our strategy of selling calls sets us up to be sellers when others are in a buying frenzy. That's why it works so consistently!

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.