Everything is AWESOME!

Europe's markets are up 2.5-3% and our Futures are already up over 1.5% because... well just because so LET'S PARTY like it's 1999 - or that part of 2008 when we thought a small bounce was a sign to jump right back in about 50% from the actual bottom - AWESOME!!!

Just check out the awesome move the S&P is making, right back to test the 1,890 line. Unfortunately, 1,890 just so happens to be the line we predicted we'd bottom at 2 WEEKS AGO (see 1/11's "Meaningless Monday Market Movement") along with 16,200 on the Dow, 9,350 on the NYSE and 1,000 on the Russell. In fact, we're still DOOMED if the Russell can't get back over 1,050 next week. I didn't have a Nasdaq target but we said AAPL would bottom at $96 and it tested $96 yesterday but finished at $96.30 - so I'm going to count that one!

I already sent out a Morning Alert to our Members discussing all the charts and levels and news and stuff, so I won't get back into it here. I also tweeted it out so you can read it for free and get a glimpse into the kind of nonsense we get paid for. In that note, you'll see the following trade idea for our Members:

Still a chance to play copper (HG) on cross over the $2 line.

Someone Is Trying To Corner The Copper Market. One company whose identity is unknown, is "hoarding as much as half the copper available in warehouses tracked by the London Metal Exchange."

We had two chances to make money on copper so far this morning - first at a penny and then for 1.5 cents as we stopped out on a rejection at the $2.02 mark. That may not seem like a big deal but /HG contracts pay $250 per penny, per contract! This is how we make our Egg McMuffin money at Philstockworld or, as one of our Members (Burrben) said:

Good job on Hg. Helping me fund my daughters school!

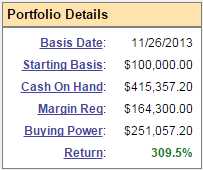

Hopefully we can fund a lot of educations as our super-bullish Options Opportunity Portfolio came roaring back from the dead with a 20% gain on yesterday's bounce. That's up 20% since we talked about how badly it was doing in Wednesday's Live Trading Webinar at about 1:30pm - not bad for a day's work! We're certainly going to lock today's gains in with a hedge - like the ones we discussed in yesterday's morning post, though now we'll be able to take more aggressive positions thanks to a 2.5% pop in the indexes.

Our more hedged Butterfly Portfolio gained 12% yesterday and our Long-Term Portfolio blasted 10% higher along with the Short-Term Portfolio but still not back over the $1M mark for the pair, which is up 66% in two years but today should hit $1M and, again, we'll be locking in some of these gains with those hedges after we removed them all in our bottom call last Thursday (see "Fearful Thursday – Are the Markets DOOMED? Breaking Down the Dow" for our logic in calling a long).

Our more hedged Butterfly Portfolio gained 12% yesterday and our Long-Term Portfolio blasted 10% higher along with the Short-Term Portfolio but still not back over the $1M mark for the pair, which is up 66% in two years but today should hit $1M and, again, we'll be locking in some of these gains with those hedges after we removed them all in our bottom call last Thursday (see "Fearful Thursday – Are the Markets DOOMED? Breaking Down the Dow" for our logic in calling a long).

And where was the S&P last Thursday? 1,890 at Wednesday's close of course. Our 5% Rule™ never lets us down! We called the bottom Thursday morning but didn't start buying until the next day, when we bottomed at 1,860 and this week we've continued to do some bottom-fishing (as I mentioned in the morning posts). Please keep in mind though that our 5% Rule™ also says that, so far, this is nothing but a weak bounce and we need another 2% move higher (3% from today's open) before we're feeling more confident over the strong bounce line and, even then - if we're rejected there - we're still DOOMED!

Next Wednesday is the Fed Meeting and ANYTHING can happen there and it's widely expected that China will do SOMETHING over the weekend and, if they don't - we could get right back to having a rough ride but, for now - enjoy the bounce!

Have a great weekend,

- Phil

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.