Here's an indicator that has successfully predicted major market corrections:

It's the so-called "Smart Money Indicator" which tracks the number of bearish put options vs the number of call options with the expectation that options traders have some clue as to what the market is doing - as they tend to be more serious investors (the ones that survive, that is). Of course, it also gave a false warning , like it did in 2003 and 2012 and last fall, when we first went over the 2:1 line but now it's just getting silly and open put contracts now exceed call contracts by 3:1 for the first time ever.

Once again, I'm not saying we should join them and get all bearish - I wish it were that simple. Unfortunately Fundamentals have been thrown out the window in this Global QE environment and all I can do is warn you that it's not a good time to be betting the market goes higher and the smart move is to have a ready supply of CASH!!! on the sidelines - just in case the market completely collapses.

We're well-hedged and very cashy in our Member Portfolios and thank goodness for that because, according to Bespoke, the average stock in the S&P 500 is 20% BELOW it's 52-week high. That would be called a correction but, as I've noted before, there are 8-10 stocks that have accounted for all of the S&Ps positives this year. Other than those few headline stocks, EVERY SINGLE SECTOR is off 10% or more this year:

The smart money is in CASH!!! We are in CASH!!! Cash is good, it's not some failure on your part if you don't see anything good to invest in and you sit on the sidelines. This is something I have to work very hard to teach our new Members - that sometimes the only winning move is not to play. Yes, while you are in cash you will see things you wanted to buy going up and you will regret it. That's because human nature is to focus on "the one that got away" rather than the stocks you actually would have bought that tanked. Think of every baseball game you ever played - do you ever talk about the strikeouts?

Babe Ruth was the greatest hitter of all time. In addition to 714 home runs he also had a spectacular .342 lifetime batting average, putting him 8th all-time in that category. Still, the Bambino struck out 1,330 times, almost twice as many times as he hit a home run but, unlike Mighty Casey, no one focuses on those, do they?

Babe Ruth was the greatest hitter of all time. In addition to 714 home runs he also had a spectacular .342 lifetime batting average, putting him 8th all-time in that category. Still, the Bambino struck out 1,330 times, almost twice as many times as he hit a home run but, unlike Mighty Casey, no one focuses on those, do they?

Traders are no different, nor are venture capitalists or real estate flippers - everyone talks about their home runs but the great ones hit for average, knowing there will be some home runs in there - as long as they stay consistent. Portfolio management is like that too - the really great returns come from steady, consistent gains - not swinging for the fences and the great hitters know when NOT to swing at a pitch, something we try very hard to teach our Members.

The conditions simply are not favorable right now so the smart thing to do is get to the sidelines and wait for better conditions. Sure there are still stocks we like, but we play them from well-hedged positions with conservative entries - just in case the market corrects. If the market doesn't correct - then we'll "only" make 10-20% because we've limited the upside with our hedges - hardly a tragedy. In fact, we only WISH the S&P had returned 10-20% this year, right?

Somehow Russia was the best place to play in 2015. That's mostly because it was a complete disaster in 2016, falling 50% so +23% is like going from 100 to 50 and then back to 61.5 (do the math, this is another thing that confuses traders), which is what our 5% Rule™ calls a "weak bounce", not a recovery. The same goes for the other "leaders" - they just happened to fall in 2014 and made a minor recovery in 2015 - arbitrary calendar cut-offs should not drive your investing decisions, should they?

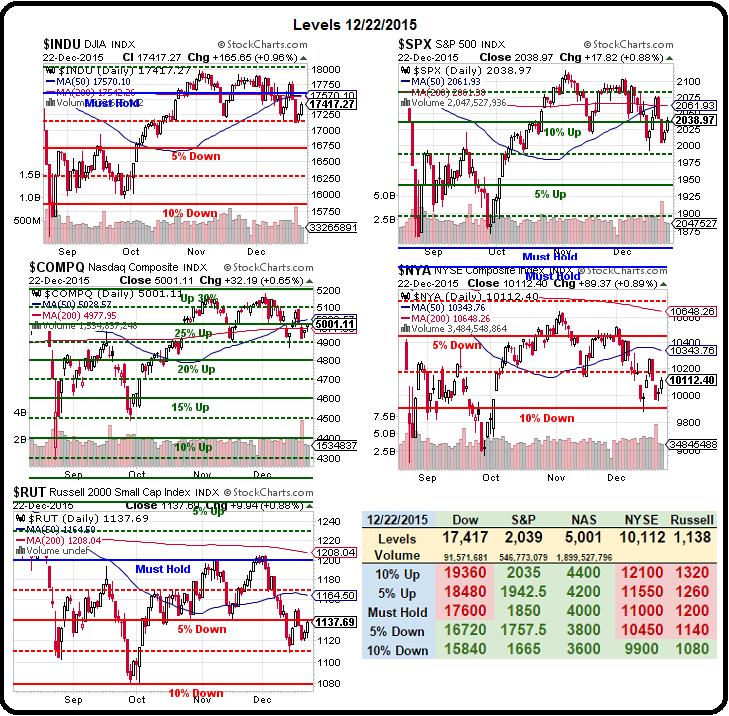

Speaking of our 5% Rule™, let's calculate our strong and weak bounce lines so we don't get sucked in by this low-volume "rally" we're getting - which is mainly an attempt to dress the windows into the end of the year. It's hard for brokers to get you to put your money into stocks if the market is negative in their brochures - so they often "fix" the market before they have to go to press in January.

Dow was rejected at 18,000 and bottomed at 17,100 (-5%) and our 5% Rule says we get 180-point bounces to 17,280 (weak) and 17,460 (strong) - we're just under the strong line but, more importantly, even if we make that, we're still under the Must Hold Line at 17,600 - that's the only real sign of recovery for the Dow.

S&P 2,100 has been our line in the sand all year and we've been very successful playing it short - over and over and over again. We pretty much fell to 2,000 and, in fact, tested the -5% line at 1,995 last Monday (14th). That means we're looking for 20-point bounce to 2,120 (weak) and 2,140 (strong) and we stopped just one point shy of strong yesterday and should open over it today. Will it hold? Almost certainly as Europe is also dressing windows this morning (up 2%).

Nasdaq 5,000 is the mythical line from February of 2000, which we briefly touched before falling back to 1,300 (down 74%) in July of 2002. How many times along the way did they say Tech was about to turn back up? We were actually back at 1,300 in March of 2009 (when I said BUYBUYBUY) and now right on that 5,000 mark again. 5,150 was the high and 4,900 is where we bottomed on this run so 250 points is - SURPRISE! - a 5% drop and that makes our bounces 50 points each to 4,950 (weak) and 5,000 (strong) and SURPRISE! again, that's where we are. See why we love our 5% Rule™ - it actually works!

NYSE and Germany's DAX have the same lines and the NYSE dropped from 10,450 to 9,950 and again, that's 5% and here we're looking for 100-point bounces to 10,150 (weak) and 10,250 (strong) and the broader index is, of course, only at the weak bounce line - because you can't manipulate the NYSE by goosing a few headline stocks the way you can with the Dow, S&P and Nasdaq.

Russell is another broad index and, if my theory that the major index are being manipulated to fake results into the end of the year so Brokers can feed the Retailers a line of BS next quarter - then we'd expect the Russell to also be only at the weak bounce line, right? Well the Russell has fallen from 1,200 at the beginning of the month to 1,120 and that's 80 points, which is 6.66% (the mark of the Blankfein!) and we look for 16-point bounces to 1,136 (weak) and 1,154 (strong). Where are we (drum roll please)? 1,138!

Russell Futures (/TF) are just under 1,140 and, if they go over, that's the way I'd play this rally long (tight stops below)

So there's the math behind my flippant statements that this is a BS rally that you shouldn't be sucked into. Stop watching the market - go spend time with your family and enjoy being in CASH!!! Buy a drone before the new regulations kick in - take a trip or just go out and enjoy the warmest Christmas ever by walking around NYC in a tee-shirt and taking strange Christmas photos for your friends.

There will be plenty of opportunities to trade next year and PLENTY of stocks are still very cheap - if this turns out to be a real rally.

Have a very merry Christmas,

- Phil

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.